As of 14 June 2023, HMRC has significantly updated the terms of its Contractual Disclosure Facility (CDF), under Code of Practice 9 (COP9). … Read more

Here are some of the risks trustees should be aware of and how you can get the balance right. … Read more

Join us for our annual Academies annual update event with Stone King … Read more

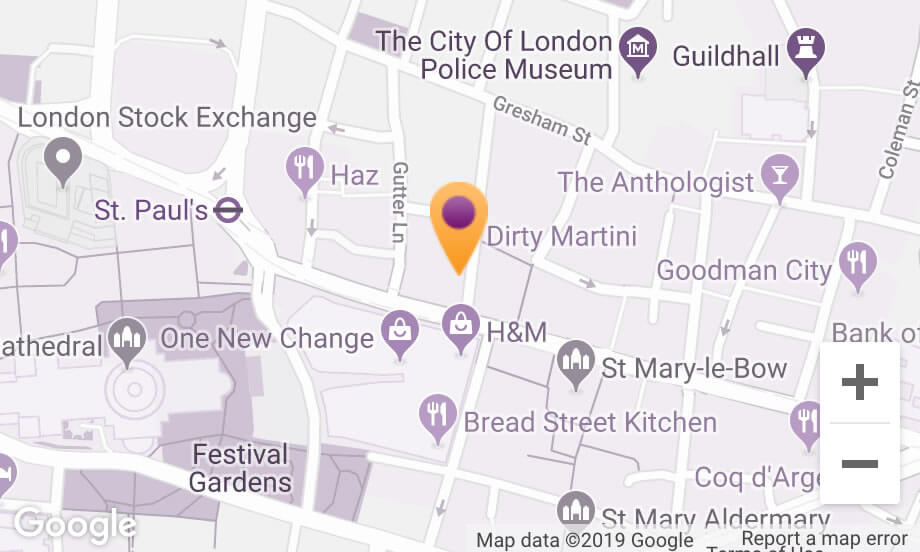

130 Wood Street, London, EC2V 6DL

enquiries@buzzacott.co.uk T +44 (0)20 7556 1200

The IRS has released new rules regarding Foreign Pensions, detailed in Revenue Procedure 2020-17. The Revenue Procedure stipulates that Forms 3520 and 3520A are no longer required for certain self-funded pension plans held under trust. This would include UK Self Invested Pension Plans (SIPPs), which many of Buzzacott’s clients have.

If you own this type of pension, in order to qualify for the exemption you must be US tax compliant and the pension must be qualified as a recognised pension in a foreign jurisdiction.

To qualify for the reporting exemption, the Revenue Procedure stipulates that pensions would need to satisfy certain legal requirements, which include:

In simple terms, neither criteria 4 or 5 are met by SIPPs. People not working can still contribute up to £3,600 to SIPPs, so you can contribute regardless of employment. In fact, contributions are not limited at all, rather the UK tax relief is.

It may very well have been the intention of the Revenue Procedure to eliminate the 3520/3520A requirement for foreign pensions such as UK SIPPs, but at this stage we disappointingly conclude that it doesn’t. We have raised some questions directly to the author of the Revenue Procedure, though we are yet to hear back. Once we do, we’ll update this article.

It should however be noted that the Revenue Procedure does cement our basis for preparing Forms 3520A and 3520 for a personally funded foreign pension held under trust, which is not a view held by all preparers. We are of the opinion that it may still make sense to continue to file these forms until we have more information and hopefully more news from the IRS.

The IRS has released new rules regarding Foreign Pensions, detailed in Revenue Procedure 2020-17. The Revenue Procedure stipulates that Forms 3520 and 3520A are no longer required for certain self-funded pension plans held under trust. This would include UK Self Invested Pension Plans (SIPPs), which many of Buzzacott’s clients have.

If you own this type of pension, in order to qualify for the exemption you must be US tax compliant and the pension must be qualified as a recognised pension in a foreign jurisdiction.

To qualify for the reporting exemption, the Revenue Procedure stipulates that pensions would need to satisfy certain legal requirements, which include:

In simple terms, neither criteria 4 or 5 are met by SIPPs. People not working can still contribute up to £3,600 to SIPPs, so you can contribute regardless of employment. In fact, contributions are not limited at all, rather the UK tax relief is.

It may very well have been the intention of the Revenue Procedure to eliminate the 3520/3520A requirement for foreign pensions such as UK SIPPs, but at this stage we disappointingly conclude that it doesn’t. We have raised some questions directly to the author of the Revenue Procedure, though we are yet to hear back. Once we do, we’ll update this article.

It should however be noted that the Revenue Procedure does cement our basis for preparing Forms 3520A and 3520 for a personally funded foreign pension held under trust, which is not a view held by all preparers. We are of the opinion that it may still make sense to continue to file these forms until we have more information and hopefully more news from the IRS.

Please speak to your Buzzacott contact if you have any questions on the US/UK tax treatment of your non-US pension and stay in touch for any updates.

We use necessary cookies to make our site work. We’d also like to set optional analytics and marketing cookies. We won't set these cookies unless you choose to turn these cookies on. Using this tool will also set a cookie on your device to remember your preferences.

For more information about the cookies we use, see our Cookies page.

Please be aware:

— If you delete all your cookies you will have to update your preferences with us again.

— If you use a different device or browser you will have to tell us your preferences again.

Necessary cookies help make a website usable by enabling basic functions like page navigation and access to secure areas of the website. The website cannot function properly without these cookies.

Analytics cookies help us to understand how visitors interact with our website by collecting and reporting information anonymously.

Marketing cookies are used to track visitors across websites. The intention is to display ads that are relevant and engaging for the individual user and thereby more valuable for publishers and third party advertisers.